flow-through entity tax form

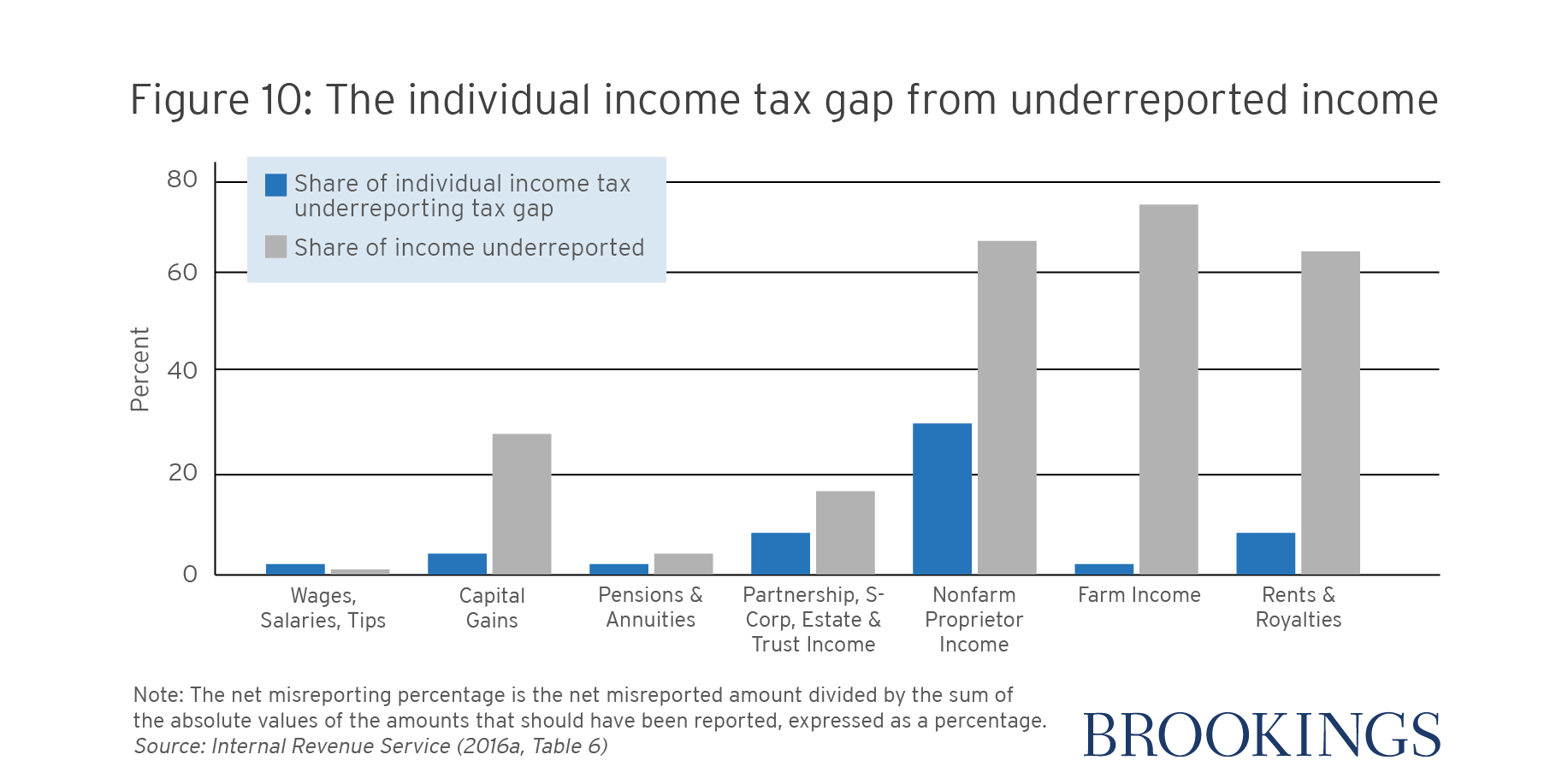

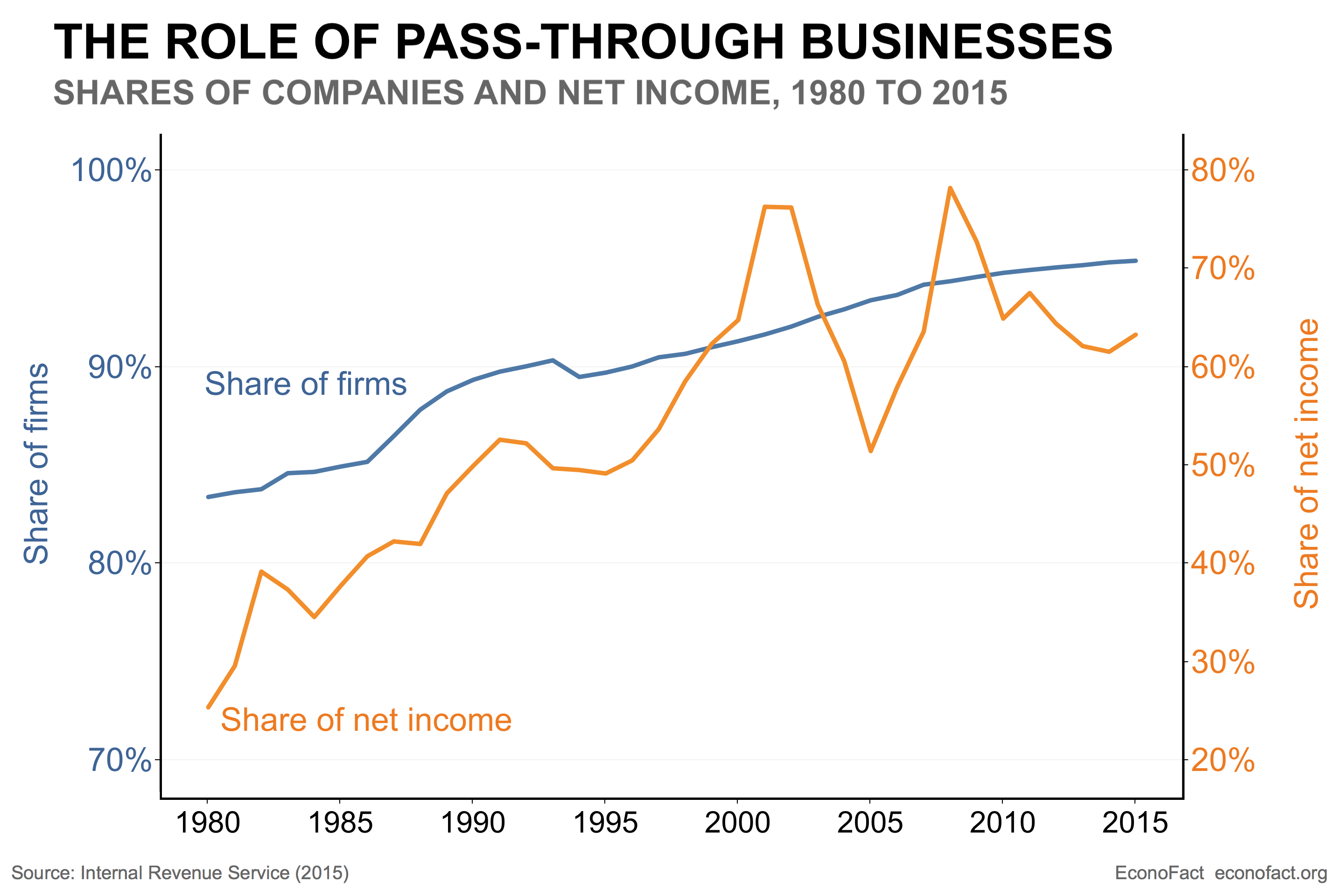

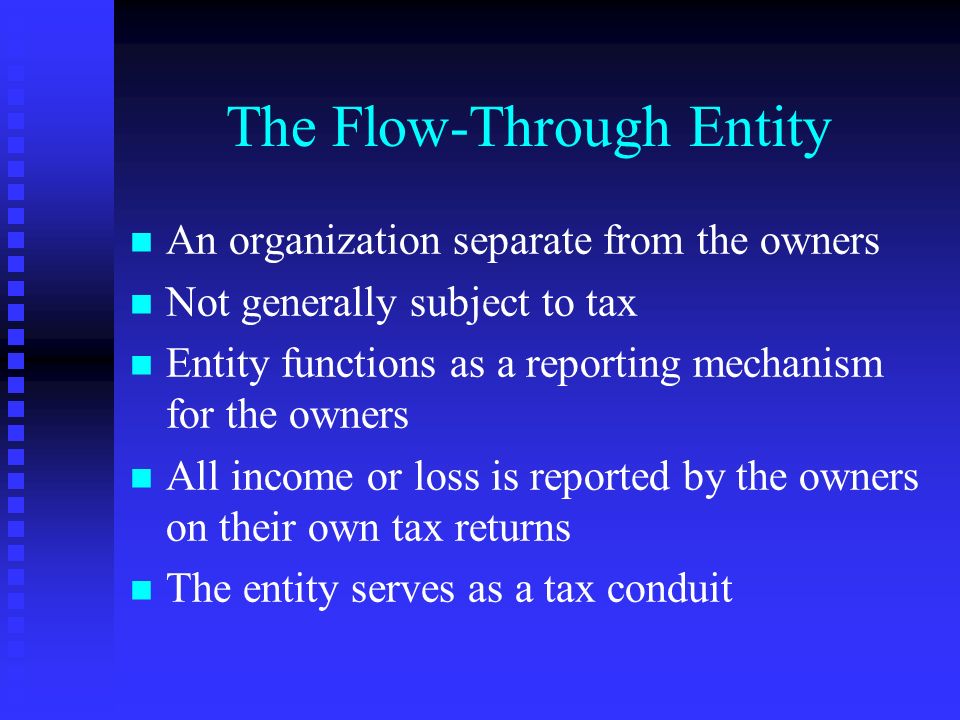

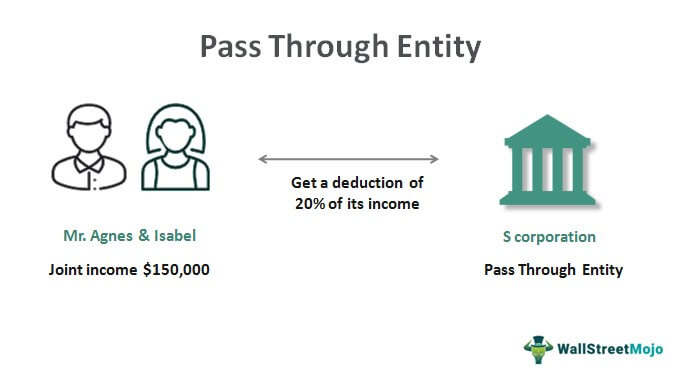

Exist flow-through entities that do not appe ar as payors in the Tax Year 2000 K -1 data base. A pass-through entity is an entity whose income loss deductions and credits flow through to members for Massachusetts tax purposes.

Pass Through Entity Tax Annual Filing Demonstration Youtube

The most common type of flow-through entity is.

. New York City Pass-through Entity Tax. The Michigan Department of Treasury recently issued templates to assist taxpayers with filing their 2021 Michigan Flow-Through Entity FTE Tax Returns. Effective January 1 2021 the Michigan flow-through entity FTE tax is levied on certain electing.

Form 5774 Instructions 2021 Purpose This form is a supporting schedule used to report member information for a flow-through entity filing the Flow-through Entity Tax Annual Return. A business owned and operated by a single individual. Governor Whitmer signed HB.

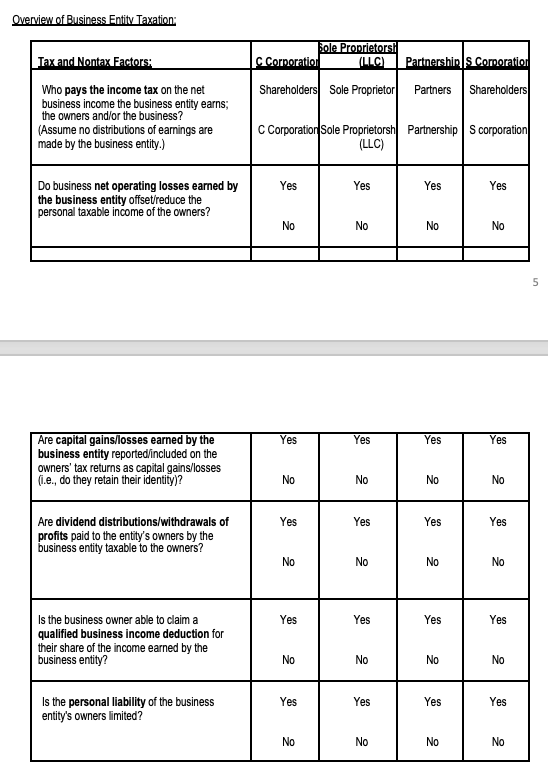

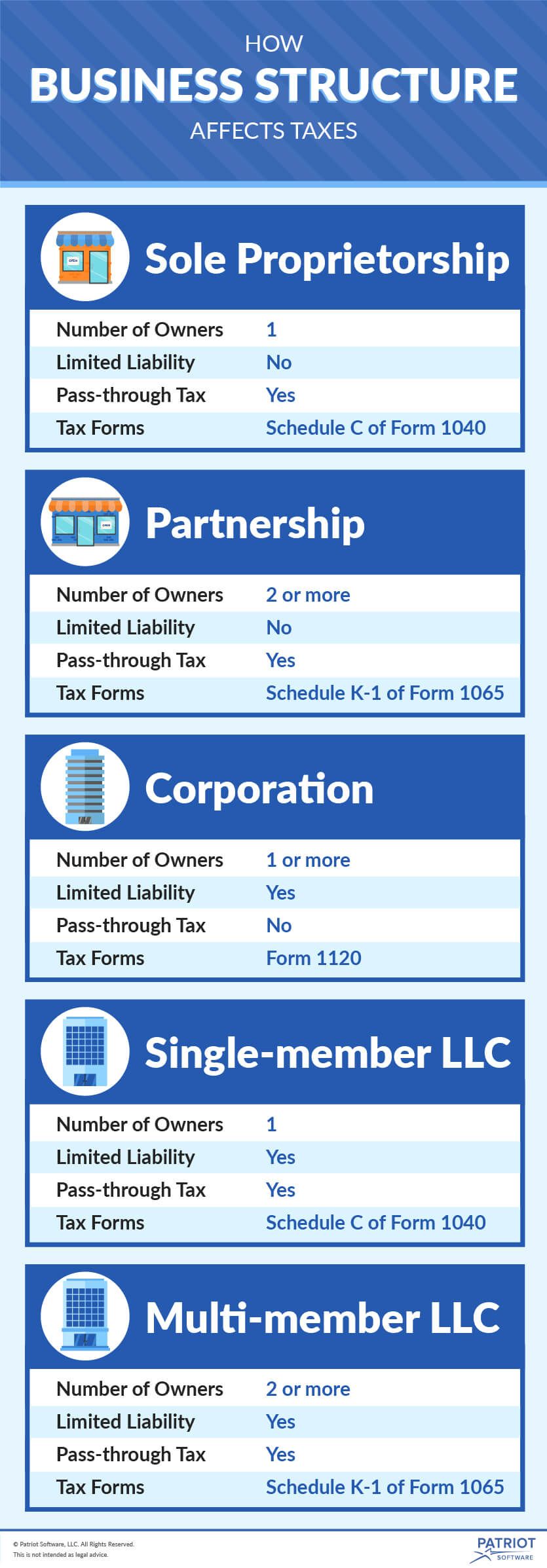

5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan. Types of flow-through entities. There are three main types of flow-through entities.

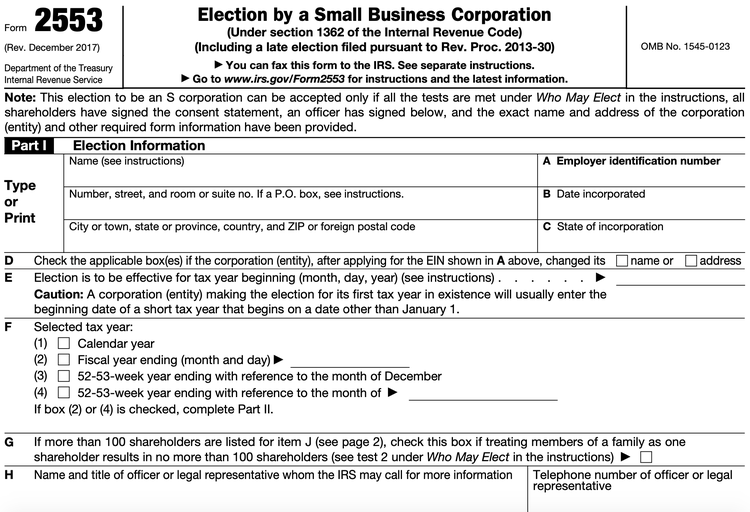

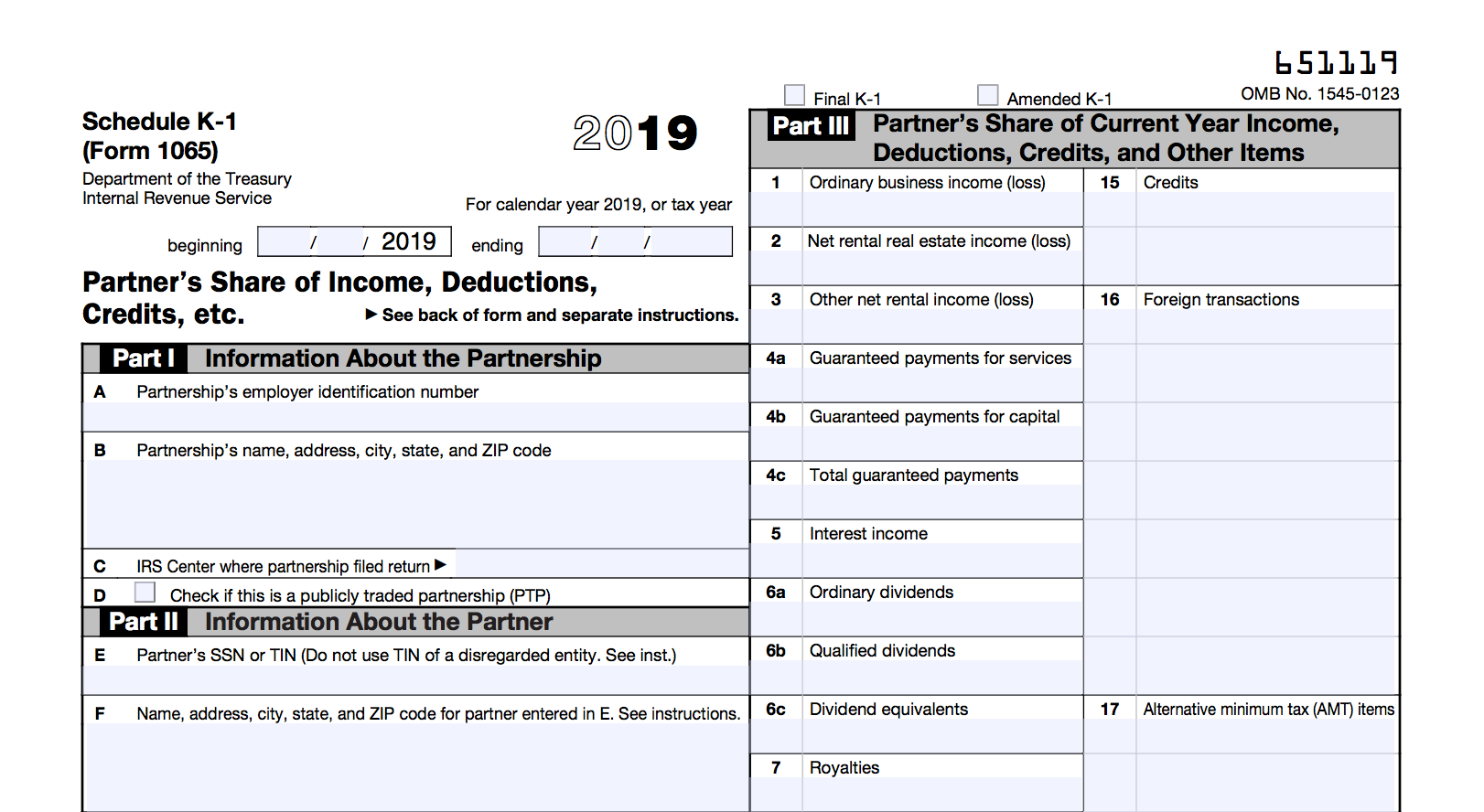

Form 1065 trusts which file Form 104 11 and Subchapter S Corporations. For further questions please contact the Business Taxes Division. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

Income that is or is deemed to be effectively connected with the conduct of a. This rule applies for purposes of NRA withholding and for Form 1099 reporting and backup withholding. T he Pass-through Entity PTE tax is an entity-level income tax that partnerships other than publicly traded partnerships under IRC 7704 and subchapter S corporations may elect to pay.

The following are all pass-through entities. For calendar filers that date. Form 5773 Non-electing Flow-Through Entity Income.

This legislation was passed as a. The governor has signed legislation allowing eligible entities to opt in to the New York City pass-through entity tax for 2022. 2021 PA 135 introduces Chapter 20 within Part 4 of the Michigan Income Tax Act.

2021 Flow-Through Entity Tax Annual Return Form Warning Save functionality for FTE returns is forthcoming in the meantime enter all return data in one session. The flow-through entity tax annual return is required to be filed by the last day of the third month after the end of the taxpayers tax year. A flow-through entity is an entity through which income flows to the owners or investors without being subject to taxation at the entity level.

This guidance is expected to be published in early January 2022 and will be posted to the Departments website. Through entity receiving a payment from the entity I certify that the entity has obtained or will obtain documentation sufficient to establish each such intermediary or flow-through entity. Flow-Through Entity Tax Ask A Question Figures Needed for FTE Reporting Frequently Asked Questions Report and Pay FTE.

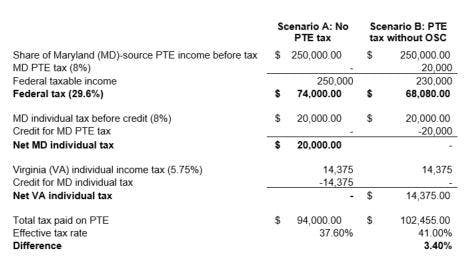

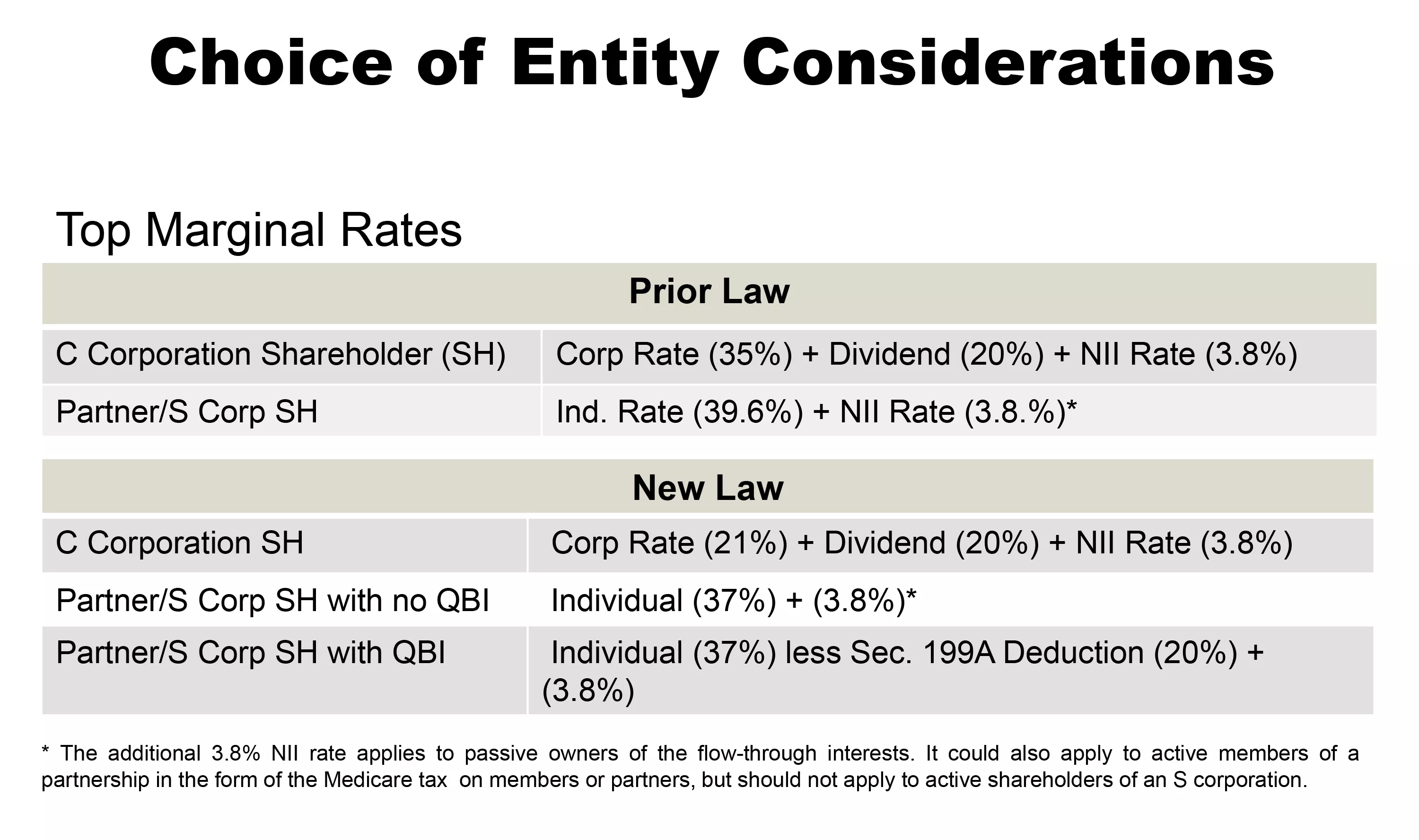

This optional flow-through entity tax acts as a workaround to the state and local taxes SALT cap which was introduced in the Tax Cuts and Jobs Act of 2017 to limit the. Branches for United States Tax Withholding and Reporting.

Flow Through Entity Example Chantelle Larry Chegg Com

Reminder New York State Pass Through Entity Tax Ptet Annual Election Deadline Is Oct 15 Marks Paneth

The Other 95 Taxes On Pass Through Businesses Econofact

The Tax Dance To Pass Through Or Not To Pass Through Income Wall Street Oasis

The Latest On The New York Pass Through Entity Tax Marks Paneth

Pass Through Entity Tax 101 Baker Tilly

Pass Through Business Definition Taxedu Tax Foundation

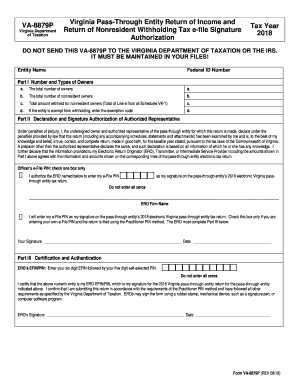

Fillable Online Tax Virginia Virginia Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax E File Signature Authorization Fax Email Print Pdffiller

Module 22 Operations Of Flow Through Entities Menu 1 1 Definition Of A Flow Through Entity 2 Reporting The Operations Of A Flow Through Entity Ppt Download

Business Entity Tax Basics How Business Structure Affects Taxes

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

The Choice Is Yours 3 Ways For Llcs To File Federal Income Tax Xendoo

Form 84 105 Pass Through Entity Tax Return

Pass Through Entity Definition Examples Advantages Disadvantages

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Form 84 122 Pass Through Entity Net Taxable Income Schedule